TAE Technologies just leapt into the public market spotlight. The private fusion developer says it will merge with the parent of Truth Social in a deal valued near 6 billion dollars. That pairing, media and crypto on one side, long horizon fusion on the other, is set to test investor nerve and imagination in equal measure. ⚡

What happened and why it matters

The companies unveiled plans to combine into a single, publicly traded platform focused on both digital media and advanced energy. The headline number is about 6 billion dollars. Final terms were not fully detailed. Closing will depend on filings, approvals, and shareholder votes.

This is not a typical tie up. TAE is a California based fusion developer. It has raised significant private funding over many years. It does not sell power today. Truth Social’s parent is a politically connected media and crypto brand with a volatile share base. Each side brings reach, cash needs, and a story that can move markets.

Strategy, not synergy

There is a clear strategic logic even if the businesses do not naturally fit.

- TAE gains public currency, a path to raise capital at scale, and daily visibility.

- The media company gains a growth narrative outside advertising and tokens, and a claim on future energy upside.

Fusion is capital intensive. Program costs can run into the billions before a single watt is sold. Public equity, even with swings, can be a powerful funding tool. The media brand, in turn, is diversifying away from a single revenue stream. It is also anchoring itself to a long duration technology story that can attract patient capital.

Expect sharp price swings, wide bid ask spreads, and changing narratives day to day. Volatility is a feature here, not a bug.

Market read, near term and long term

Do not expect clean comps. The combined entity will trade on sentiment, deal milestones, and policy headlines. Options pricing is likely to reflect elevated uncertainty. Borrow availability may be tight. Short interest can spike. That can fuel squeezes in either direction.

Institutional money will watch the filing trail. The key documents will be the merger agreement, pro forma financials, and the risk section in the registration statement. Capital structure will matter. Look for details on cash at close, potential PIPEs, lockups, earn outs, and any minimum cash conditions. Without strong cash funding, fusion timelines will stretch.

For energy investors, the union puts fusion back on the front page. For media investors, it introduces deep tech risk that cannot be solved with marketing. That tension will drive valuation.

Deal math drives returns. Focus on exchange ratios, voting control, lockup periods, and minimum cash covenants once disclosed.

The fusion reality check

TAE pursues an alternative plasma approach that aims at cleaner, aneutronic fuels over time. The physics path is ambitious. It is also uncertain. There is no commercial fusion plant in service anywhere today. Pilot facilities, regulatory frameworks, and grid integration remain works in progress. Timelines are measured in years, not quarters.

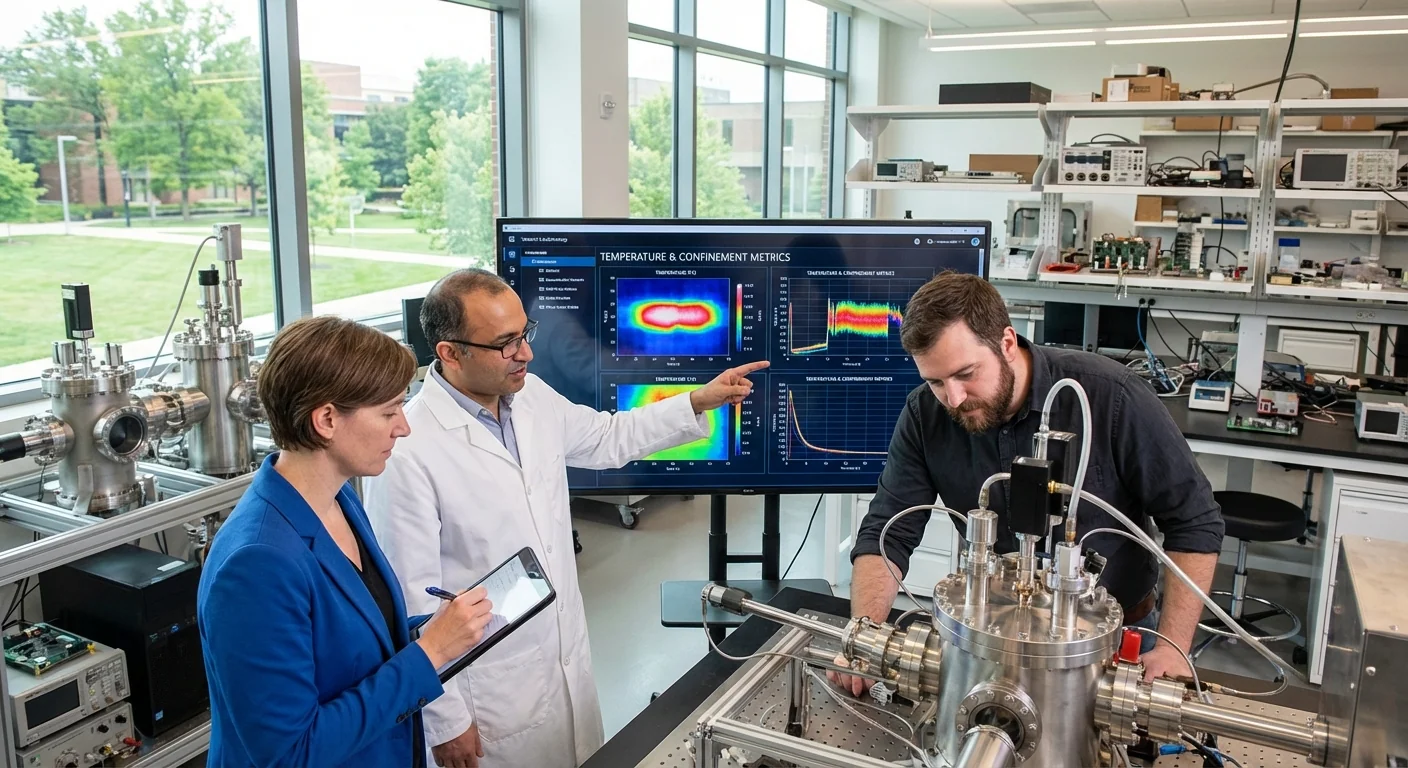

Investors should plan for steady cash burn. Rounds will likely be staged around technical milestones. Success will depend on hitting temperature, confinement, and stability targets, then scaling hardware and power systems at cost. Government programs can help, but private capital will still shoulder much of the load.

Policy and oversight

The deal will draw attention in Washington. Energy security is a national priority. Political ties raise questions on governance, disclosure, and potential conflicts. The SEC will review transaction filings. Committees may ask about data sharing, cyber risk, and how a media platform sits next to critical energy research. None of this is fatal. It does add friction and time.

What investors should watch next

- Detailed terms in public filings, including cash, dilution, and control.

- Any PIPE financing or strategic investors joining at close.

- Lockup expirations and insider selling restrictions.

- A credible, funded roadmap for a pilot plant and regulatory milestones.

Position sizing matters. Treat this like a venture style bet wrapped in a public wrapper. Use risk capital and clear stop rules.

The bottom line

This is a bold swing. The media company gets a moonshot. TAE gets a public runway. The market gets a lightning rod that blends meme energy with hard science. The prize is massive if fusion works at cost. The path is long, expensive, and bumpy.

For now, trade the tape and read the filings. The story will be written by cash in the bank, physics in the lab, and patience in the market.