Is ChatGPT down? Users are reporting timeouts, login hiccups, and slow replies right now. I am seeing intermittent failures in fresh sessions and elevated latencies on retries. The pattern points to a traffic surge hitting both the web app and selected API routes. This is a market story, not just a tech blip. When the most visible AI tool wobbles, money shifts.

What I am seeing right now

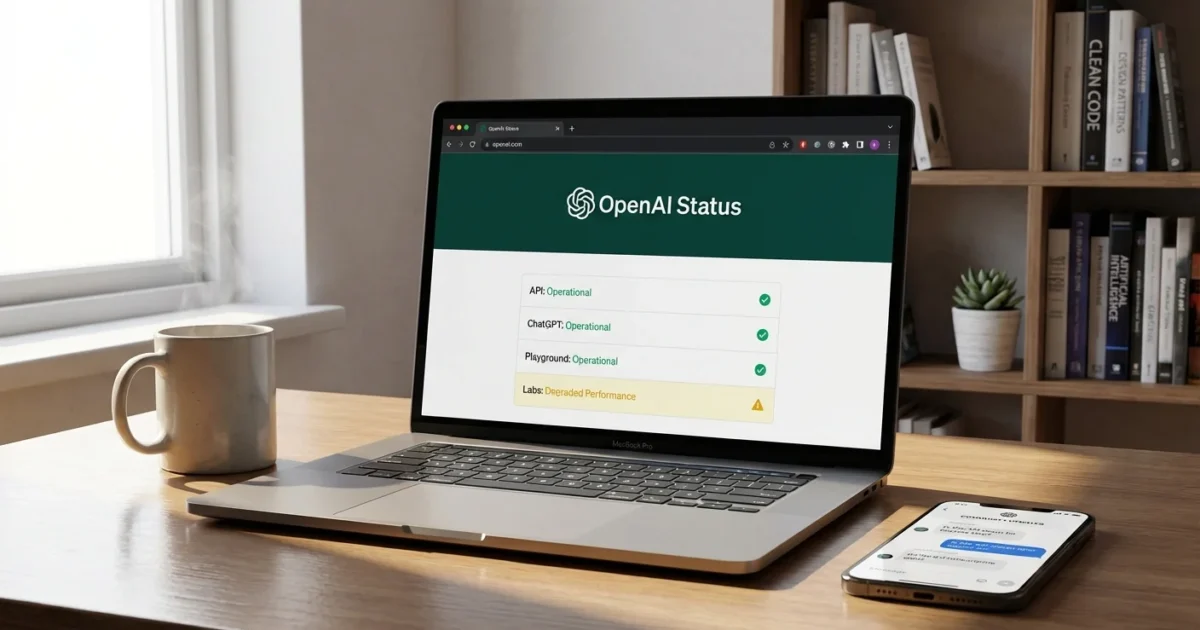

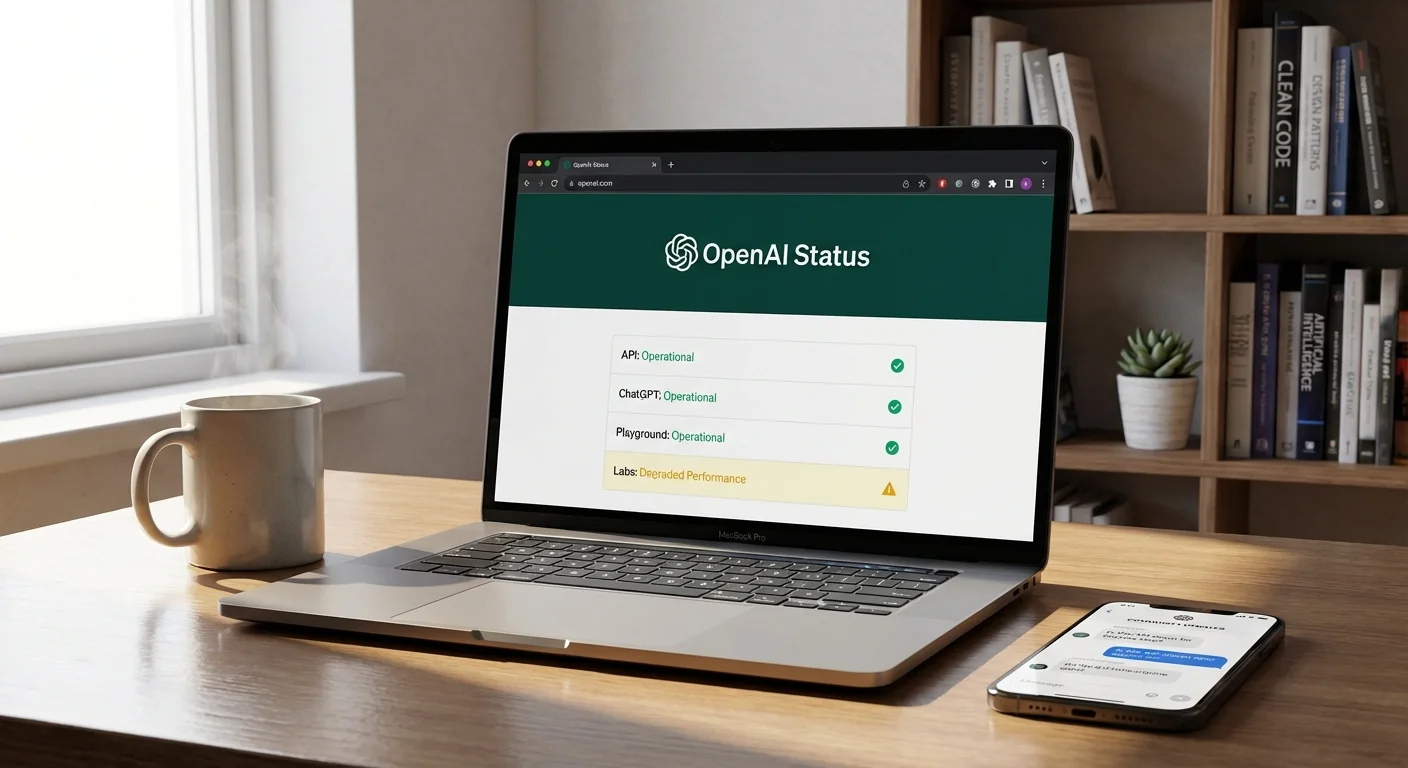

Access is inconsistent. Some chats open cleanly, then stall. Others fail on first attempt, then load on refresh. API calls return errors in bursts, then clear. That staggered behavior is typical when demand spikes, not when a full outage hits. If you need a definitive read, the official status page is the first stop at status.openai.com. It shows component level signals for the web app, the API, and logins. Community monitors can add color in real time, but the status page is the source of record.

If your chat hangs, wait 30 to 60 seconds. Then retry once. Rapid retries can make queues worse.

Why this matters for markets

AI is now production plumbing for code, support, and content. A slowdown can ripple through sales pipelines, customer service teams, and dev cycles within minutes. That has pricing power and revenue timing effects. It can also move stocks tied to the AI stack.

Microsoft is exposed through Azure, Teams integrations, and Copilot bundles. Nvidia sits at the center of model training and inference supply. Oracle hosts OpenAI workloads for some customers, and is pushing hard into AI infrastructure. Super Micro, Broadcom, and Arista ride the buildout of AI data centers. If today’s strain is mainly demand driven, it underscores the need for more inference capacity and network gear. If it is software related, it highlights operational risk, resilience gaps, and the value of multi‑provider strategies.

The web app and the API can have different statuses. Enterprise and Teams environments often route differently, so they may behave better than the public site during spikes.

The Nvidia and OpenAI news catalyst

Fresh headlines today put the Nvidia and OpenAI relationship back in the spotlight. Nvidia’s chief played down talk of drama, and signaled openness to backing a future OpenAI IPO. There is also renewed focus on Oracle’s role and what it stands to lose or gain as that relationship evolves. That cluster of headlines draws more users to try ChatGPT. Extra attention becomes extra traffic. When demand jumps fast, login and auth steps are often first to strain, which matches what I am seeing, short stalls and occasional errors rather than a hard stop.

This is the tell for investors. A demand shock that degrades but does not fully knock out the service suggests usage is outpacing tuned capacity in bursts. That is bullish for consumption, neutral to negative for short term user experience. Providers then have two choices. Add headroom, which lifts spend and capex at cloud and chip suppliers. Or throttle features, which protects margins but risks churn. Watch how quickly performance snaps back and whether usage controls tighten.

Near term economic implications

Every extra second of latency costs money when scaled across millions of requests. Sales reps wait on draft emails. Support agents wait on suggested replies. Developers wait on code edits. Multiply a 30 second delay by a large workforce, and productivity dents show up inside the quarter. For startups built on the API, even a brief slowdown can trigger SLA penalties or higher support costs.

For the chip and cloud trade, this moment is a micro stress test. If the fix comes fast without throttling, it signals more elastic capacity on Azure and other hosting partners. If constraints persist into peak US hours, it underlines the tightness of high end GPUs and networking, and strengthens the case for more near term orders at Nvidia, Broadcom, and server assemblers.

- What to watch today

- Latency and error rates on the status page through the US close

- Any usage caps or feature limits announced for ChatGPT or API tiers

- Intra day moves in MSFT, NVDA, ORCL, AVGO, SMCI, and key cloud peers

- Messaging from OpenAI on root cause, demand spike or software issue

Beware fake status pages and phishing prompts asking you to re enter API keys. Only use status.openai.com and your normal account flow.

How to verify and troubleshoot fast

- Check status.openai.com for component updates.

- Log out, then back in. Switch to a different browser or try a private window.

- Clear cache, disable extensions, and retry on a clean profile.

- Change networks, for example mobile hotspot instead of office Wi Fi.

- Reduce load. Shorter prompts and fewer parallel requests help during a surge.

If the API is mission critical today, queue non urgent jobs, and use backoff logic in clients. Enterprises should consider failover prompts and cached responses for common tasks. That keeps teams moving while capacity recovers.

The investment takeaway

Short lived degradations are normal at this scale. The signal is where and how the system bends. A demand led slowdown is a green light for the broader AI buildout, more GPUs, faster networks, and larger cloud footprints. A software or auth bottleneck that recurs points to platform hardening needs, and that can slow the pace of new features. In both cases, resilience becomes a selling point. Expect more talk of multi cloud and model diversification on upcoming earnings calls.

This is a reminder that AI is already utility grade infrastructure. Even a small wobble hits output, costs, and sentiment. If performance stabilizes quickly, the market will look through it. If not, expect a rotation into suppliers of capacity and the platforms that prove they can stay up when the spotlight gets hottest.