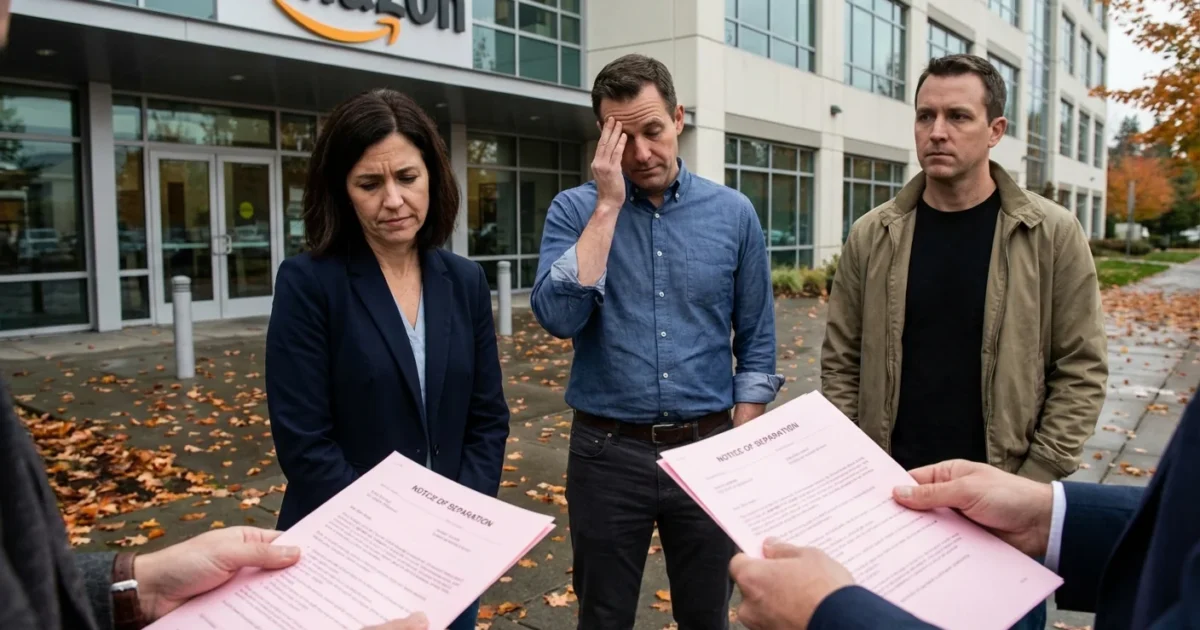

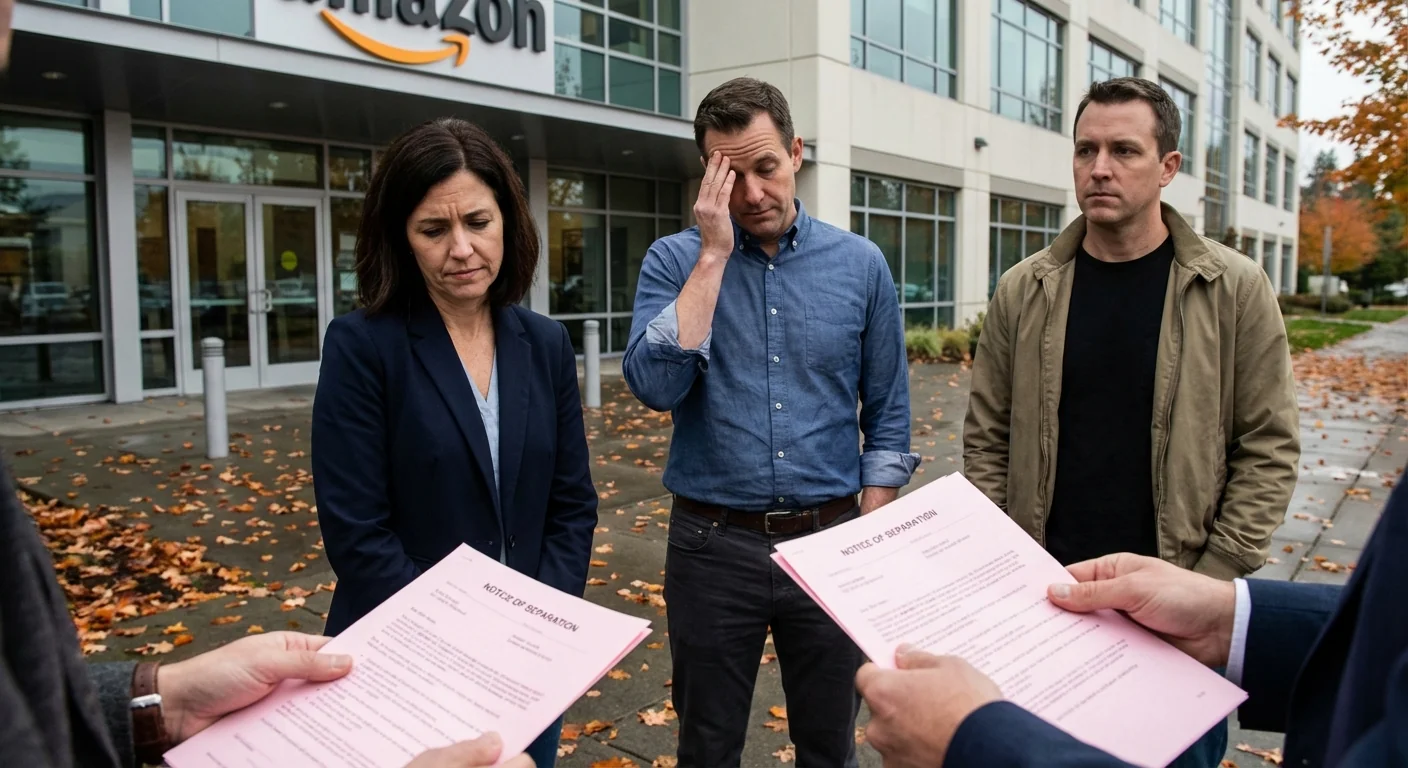

Breaking: Amazon is cutting about 16,000 corporate jobs. The company is flattening its structure to move faster and fund a bigger AI push. The cuts are part of a broad reorganization confirmed today. It is one of the largest corporate reductions at the company in recent years.

What Amazon is cutting and why

Amazon is eliminating roughly 16,000 corporate roles across multiple teams. The company described the move as an effort to cut layers, remove bottlenecks, and speed up decision making. Fewer managers and fewer handoffs should mean faster product cycles. The message to staff was clear, move people and dollars to the AI race.

Amazon did not spell out each department or severance terms. It said the focus is to streamline operations and reallocate talent to core growth areas. That includes cloud, retail, ads, and logistics, with AI tools at the center of each.

The AI bet and budget shift

This is not a small pivot. Amazon is reshaping its budget to back large models, AI services in AWS, and smarter tools across its stores and devices. Expect heavier spend on compute, data pipelines, and model training. The company wants to cut time to build and ship new AI features. That means fewer committees and faster reviews.

AWS remains the profit engine. AI services can deepen that moat. Retail and ads should also benefit, with more personalized search, dynamic pricing, and automated content. In operations, AI can reduce waste and speed delivery. If execution holds, the payoff is higher margins and stickier customers.

Investor focus should shift to AI revenue inside AWS, the mix of higher margin services, and the pace of new product launches. 📈

Market view, costs, and what to watch next

The financial math will come in two waves. Near term, Amazon will book charges for severance and real estate. Those will weigh on operating income for at least one quarter. After that, reduced payroll can lower ongoing expenses, and AI driven services can lift gross margin.

Investors will parse the headcount cuts by segment and geography once available. They will also look for updated capital spending plans tied to AI infrastructure. If Amazon tilts more dollars to AI compute and software, the growth outlook for AWS improves.

- Key checks next: restructuring charges, opex run rate after cuts, AWS AI pipeline, and hiring in AI roles

- Watch partner signals from chip vendors, software integrators, and large enterprise clients

Restructuring saves money over time, but it can slow projects that lose staff. Execution risk is real during a reorg.

What it means for Big Tech and the job market

This move shows how Big Tech is changing. Companies are flattening org charts and moving talent to AI. They want fewer layers and faster bets. The goal is speed, focus, and clear product ownership.

For workers, the market will feel a near term chill in general corporate tech roles. At the same time, demand for AI skills stays tight. Engineers and product leaders with model, data, and cloud experience will see strong interest. Pay will likely shift as well, with premium packages tied to AI heavy teams. For cities with large Amazon hubs, there may be a short term hit to local spending. That can dent housing demand and services at the margin.

Strategy and investment takeaways

This is a classic capital rotation. Cut bureaucracy, shrink slower initiatives, and put more wood behind AI. If Amazon keeps velocity high, the company can widen its lead in cloud and rebuild retail margins. The big swing factor is how quickly AI features convert to real revenue and savings.

For investors, the path is clear. Watch AWS growth and margin, ad revenue mix, and signs of faster product release cycles. A lighter cost base plus AI driven services can expand earnings power. The risk sits in integration and morale. The reward sits in higher recurring revenue and a stronger platform effect.

Conclusion

Amazon just put a hard date on its AI future. The company is trading headcount for speed, and speed for share and profits. Short term pain is likely as charges hit. But the strategy is direct. Flatten, focus, and fund AI. If execution holds, this reset could mark the next leg of Amazon’s growth story.